OCALA, FL / ACCESSWIRE / January 26, 2024 / Unleash the potential of the latest AI paradigm that transcends conventional single-modal AI techniques to tackle intricate real-world challenges. By harnessing the power of multiple modalities like machine learning, computer vision, and natural language processing, this state-of-the-art approach delivers unmatched levels of accuracy and efficiency.

With this advanced AI paradigm, you can transform your problem-solving abilities and unlock new possibilities for innovation and progress. Why settle for outdated AI methods when you can access the power of the future today? Take your performance to the next level and achieve your goals faster and more effectively than ever before. Get started with the new AI paradigm now and experience the transformative impact of this revolutionary technology.

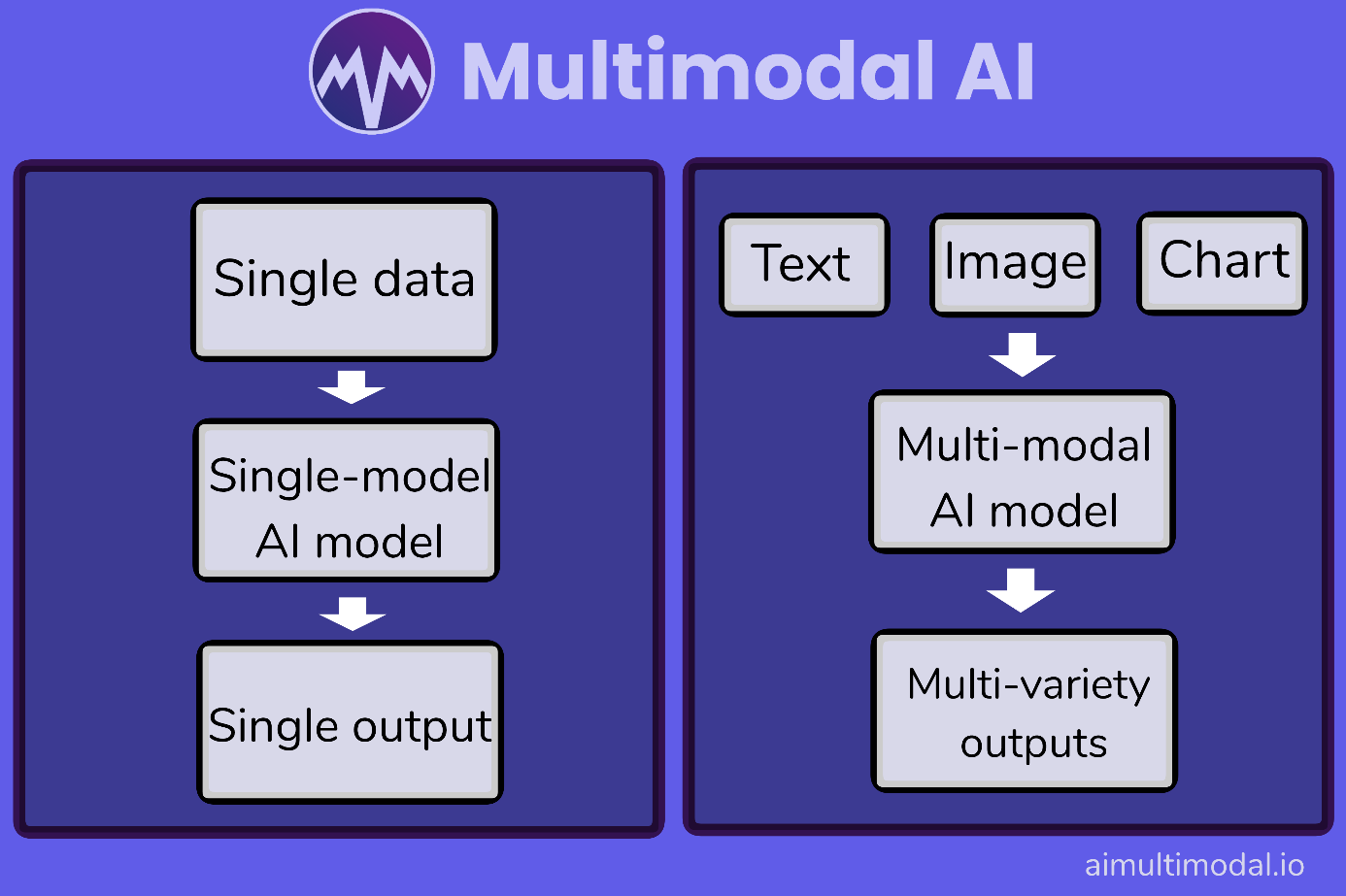

Multimodal AI VS Traditional Single-Modal

Multimodal AI is an advanced form of artificial intelligence that is designed to mimic the way humans perceive and interpret the world. It integrates data from different senses, such as text, images, and sounds, to comprehend the context and complex meaning of information. This allows for a deeper understanding of the content, as well as the ability to detect patterns and relationships that might be difficult for humans to detect on their own.

In the business world, multimodal AI is particularly valuable, as it can help us to better understand our customers. By analyzing both what they say and how they express themselves through their tone of voice or facial expression, multimodal AI can provide insight into their preferences, opinions, and emotions.

Traditional AI systems, on the other hand, are typically single-modal, meaning they specialize in one type of data, such as text or images. While they are proficient at processing large amounts of data quickly and identifying patterns that human intelligence cannot detect, they have limitations. They can be insensitive to context and less able to handle unusual or ambiguous situations.

Multimodal AI takes a step further by integrating modalities, allowing for deeper understanding and more meaningful interactions between humans and AI. With its ability to imitate human intelligence and perception, multimodal AI opens up exciting possibilities for the future of technology.

The Future of Multimodal AI

As technology evolves, the future of multimodal AI is ripe with potential and responsibility. It is expected to bridge the gap between humans and machines, leading to more intuitive and efficient systems. With applications expanding into more sectors, it will provide innovative solutions to increasingly complex problems.

However, this technological progress must also prioritize ethical AI principles. With a focus on ethical standards, transparency, and privacy, we can ensure that multimodal AI is deployed responsibly.

Our path forward is not just about technical achievements but also about aligning these innovations with societal values. By enhancing the human experience, we can create a brighter future through the responsible development of multimodal AI.

Conclusion

Multimodal AI, an amalgamation of multiple modalities, is a field that offers an array of possibilities in artificial intelligence research. These systems provide natural interaction capabilities and exhibit human-like intelligence, enabling them to achieve a more comprehensive understanding of their environment. The potential applications of multimodal AI are vast, ranging from assistive devices for people with disabilities to autonomous cars and advanced robotics.

The continued progress in the areas of multimodal data fusion, architectures, and training methods is expected to significantly expand the capabilities and usefulness of these AI systems. The move towards AI that can perceive the world through vision, audio, language, and touch in a unified way is opening up new horizons for technologies that augment human capabilities and enhance society.

The immense power of multimodal AI can revolutionize the world we live in and unlock new opportunities for societal impact. As these systems continue to develop, it is possible to pave the way towards a brighter future.

Contact us:

To learn more about our project information and support services, please click on the following link:

Website: https://aimultimodal.io

Telegram: https://t.me/aimultimodal

Xcom: https://x.com/aimultimodal

Medium: https://multimodalai.medium.com

Email: contact@aimultimodal.io

Media Contacts:

Name: Marcus N. Dailey

Website: https://aimultimodal.io

Email: contact@aimultimodal.io

Address: 1195 NE 17th Rd, Ocala, Florida

SOURCE: Multimodal AI

View the original press release on accesswire.com